Understanding Insurance Fraud

Defining Insurance Fraud

Insurance fraud occurs when a policyholder attempts to deceive an insurance company to gain benefits that would not normally be available. This could involve providing false information or withholding crucial data with the intent of monetary gain. It's worth noting that insurance fraud is not only illegal but can lead to severe penalties, ranging from increased premiums to imprisonment.

The Different Types of Insurance Fraud

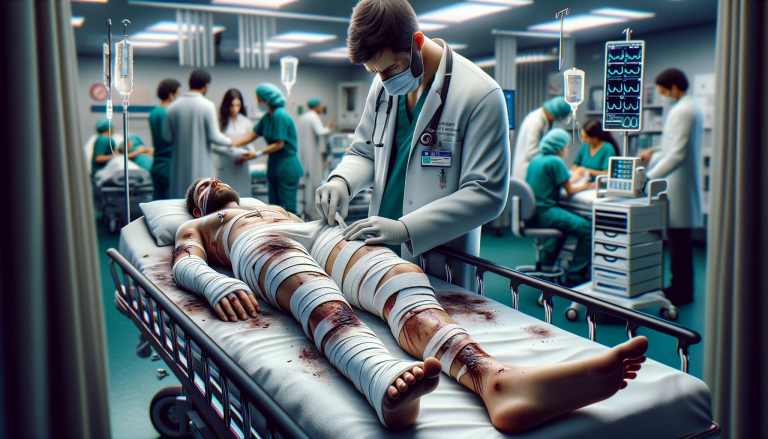

Insurance fraud isn't limited to one form; it actually varies greatly and can be seen across various types of insurance policies. The most common forms include falsified claims, inflated damages, fake

Accidents, and false medical billing among others. For instance, in car insurance, a policyholder might deliberately damage their vehicle then file a claim for the repairs. In health insurance, a patient might pretend to have a more serious condition than they actually do to receive higher benefits.

How Insurance Companies Detect Fraud

Insurance companies employ several measures to detect fraudulent claims. The most common method is through investigation units dedicated to spotting inconsistencies in claims. These may include dissonance between a customer’s claim history and the nature of their current claim, unrealistic repair costs, or conflicting witness accounts. Additionally, insurance companies use advanced data analytics tools to flag suspicious activity, helping to prevent fraudulent payouts.

Consequences of Committing Insurance Fraud

The ramifications of insurance fraud are severe, impacting both the perpetrator and other policyholders at large. Penalties vary depending on the scale of the fraud but commonly include denial of claim, cancellation of the policy, increased future premiums, and legal actions that can lead to substantial fines or even imprisonment. Furthermore, committing insurance fraud adds to the overall industry losses, which in turn drives up the cost of insurance for honest consumers.

The Legal Aspects of Insurance Fraud

Each jurisdiction has laws outlining the criminalization of insurance fraud, and these are typically enforced by regulatory bodies. For example, in the United States, insurance fraud is classified as a federal crime punishable by severe penalties. When one is convicted of such a crime, it can lead to a permanent

Criminal record, which may affect future employment opportunities and significantly tarnish one's reputation.

Types of Lies and Their Consequences

Classification of Lies

In the world of insurance, two main types of lies are recognized: material and immaterial. Material lies have a substantial impact on the assessment of a risk by an insurer, such as giving false information about one's health condition or hiding a history of

Accidents in the case of auto insurance. Immaterial lies, on the other hand, are those that would not significantly affect the insurer's decision to provide coverage or determine premiums, such as providing an incorrect phone number.

Results of Material Lies

The consequences of material lies can be severe. If discovered, the insurer has every right to deny any claims related to the misrepresented information. This could leave you with high out-of-pocket costs which you may not be able to afford. Moreover, lying can result in your policy being immediately cancelled, even if the lie was unintended or an oversight.

Consequences of Immaterial Lies

Though immaterial lies may seem insignificant, they can still have repercussions. While these lies might not lead to claim denial or instant policy cancellation, they can still harm your relationship with your insurer. They may also result in administrative errors which can cause delays in processes like claim settlements.

Legal Implications

Lying to an insurance company is considered insurance fraud, which is a crime. Depending on the severity and the laws in your jurisdiction, it can lead to hefty fines, probation, or even incarceration. Additionally, having a record of insurance fraud can make it more difficult for you to secure insurance coverage in the future.

The Impact on Premiums

Even if your dishonesty doesn't result in legal issues, it can still have long-term effects on your financial situation. Insurers might increase your premiums or you may be charged a higher rate when you seek a new policy. This is because, once you are caught lying, you will be considered a high-risk client by insurers.

The Immediate Consequences of Lying

Policy Cancellation

One of the most immediate repercussions of lying to an insurance company is policy cancellation. If dishonesty or fraud are discovered, even if unintentional, the insurer can rightfully terminate the policy. The implications of policy cancellation may extend beyond the immediate issue and could potentially lead to difficulties in obtaining future insurance coverage.

Claim Denial

In cases where a lie was disclosed during the process of a claim, insurers can completely deny the claim. Even minor inaccuracies can render your coverage void, leaving the policyholder financially responsible for any losses or damages that were initially covered by the policy.

Increased Premiums

While not as drastic as policy cancellation or claim denial, another immediate consequence of lying to an insurance company is increased premiums. Any form of dishonesty puts you at higher risk in the eyes of insurers, and this elevated risk is often reflected in higher insurance rates.

Legal Action

Extreme cases of fraud or substantial lies can lead to legal repercussions. Policyholders found guilty of insurance fraud can face fines, probation, or even incarceration. Such actions not only have immediate consequences but also long-term effects that can significantly impact one's personal and professional life.

Loss of Trust

Lastly, dishonesty invariably leads to a loss of trust. Lying to your insurer can tarnish your relationship with them. Once trust is lost, it can be challenging to rebuild, potentially affecting future transactions or contracts with the same company or others within the insurance industry.

Long-term Implications of Fraudulent Claims

The Impact on Premium Rates

When an insurance company faces a high frequency of fraudulent claims, it directly impacts the premium rates of all policyholders. The money that the company has lost is usually recovered by increasing the premium amount. Over time, this leads to a significant financial burden on honest policyholders who end up paying for the deceitful actions of others.

Legal Consequences for the Perpetrator

Anyone found guilty of committing insurance fraud may face severe legal penalties. Depending on the severity of the fraud and jurisdiction, these could range from large fines to imprisonment. In some cases, the policyholder could also be required to pay back the claimed amount. These legal repercussions can drastically affect the life of the fraudster long after the act of fraud, impacting their

Personal life, career, and overall reputation.

Decline in Trust and Reputation

Aside from financial and legal consequences, insurance fraud negatively impacts the trust between insurers and policyholders. When fraudulent activities increase, insurance companies are likely to become more skeptical about the claims they receive, leading to stricter scrutiny and longer processing times. Moreover, an individual who commits insurance fraud risks damage to their personal reputation, which can have long-lasting effects on future insurance applications and other financial dealings.

Economic Damage

Insurance fraud is not just a problem for individuals and companies involved, but it also poses a significant threat to the economy at large. Billions of dollars are lost each year due to fraudulent claims, causing economic instability. These costs often trickle down to consumers in the form of increased premiums, thus affecting a much larger population beyond those directly involved in the fraud.

Affecting Access to Necessary Coverage

Ultimately, the prevalence of fraudulent claims can compromise the very purpose of insurance: to provide protection and support when unexpected events occur. If insurance companies must focus their resources on countering fraud, they may be less able to deliver prompt and adequate coverage to honest policyholders. This can lead to a delay in claim settlements and potentially deny some individuals the insurance coverage they genuinely need.

Legal Penalties for Insurance Fraud

Financial Consequences of Insurance Fraud

The severity of the financial penalty for insurance fraud varies based on the nature and extent of the fraudulent activity. Fines can range from a few hundred dollars for small-scale fraud to millions of dollars for large-scale or organized fraud schemes. In many jurisdictions, the perpetrator may also be ordered to pay restitution to the insurance company.

Jail Time: A Serious Implication

When the offense is deemed severe enough, insurance fraud can lead to imprisonment. The length of the prison sentence depends on the scale of fraud and the laws in the jurisdiction where the crime occurred. Broadly speaking, the more egregious the fraud, the longer the potential jail sentence could be. Convicted fraudsters can face anything from a few months to decades behind bars.

Probation and Community Service

Those convicted of less severe insurance fraud may receive probation and community service instead of, or in addition to, monetary fines and imprisonment. However, even if imprisonment is avoided, the individual may still face stringent restrictions and regular supervision during the probation period. Failing to adhere to these conditions can result in harsher penalties.

Permanent Criminal Record

Another serious legal repercussion of insurance fraud is the permanent blight it leaves on the offender's public record. A

Criminal charge or conviction can significantly affect an individual's personal and professional life, making it difficult to secure employment, rent property, or pass background checks. It can also be publicly accessible in some regions, further tarnishing an individual's reputation.

Increased Insurance Premiums

Insurance fraud causes significant losses for insurance companies, which often leads to increased premiums for all policyholders. Consequently, besides the direct legal implications, insurance fraud indirectly impacts honest consumers by raising their insurance costs. Moreover, if caught, the individual perpetrating fraud will likely face higher insurance premiums in the future.

How Insurance Companies Detect Fraud

Utilization of Advanced Analytics

Insurance companies often deploy sophisticated data analytics tools to detect patterns and trends suggesting fraudulent activities. They analyze an array of data points, including claim histories, policyholder information and even social media activity. Discrepancies or unusual patterns, like recurring claims from a specific location or individual, can indicate potential insurance fraud.

Working with Special Investigation Units (SIUs)

Most insurance firms have Special Investigation Units (SIUs). These units are comprised of professionals trained specifically to identify cases of insurance fraud. Sometimes, these teams involve individuals with legal, law enforcement, or private investigation backgrounds. These experts scrutinize suspicious claims and work closely with authorities when there's an evidence of fraudulent conduct.

Implementation of Fraud Detection Software

The insurance industry heavily invests in fraud detection software that alerts them about anomalous activities in real time. This advanced software searches for discrepancies in claim submissions, policy applications, and premium payments. For instance, it can immediately flag a policy with multiple claims filed within a short period or a policyholder who regularly files claims right after their policy gets upgraded.

Reliance on Policyholder and Public Tip-offs

Insurance companies also rely on tip-offs from the public and other policyholders to detect fraud. Many firms have a confidential reporting system that allows people to report suspected fraudulent activities. These tips can provide valuable leads, enabling companies to investigate and potentially prevent insurance fraud.

Collaborating with Anti-Fraud Organizations and Networks

Lastly, insurance companies often collaborate with anti-fraud organizations and networks. They share information and insights about fraud trends and preventative measures. This collaborative approach helps insurers stay one step ahead of fraudsters, ensuring they can quickly identify and respond to emerging fraud techniques and strategies.

Ways to Avoid Insurance Fraud

Understand the Implications of Fraud

Education is the first step to avoiding insurance fraud. It's essential to understand that insurance fraud isn't a harmless act but a serious crime punishable by law. When you misrepresent facts to an insurance company with the intent of gaining benefits you are not entitled to, it's considered fraudulent. Penalties can range from hefty fines, increased insurance premiums to jail time in severe cases.

Maintain Honest Communication

Always be truthful in your interactions with your insurance company, especially when applying for a policy or filing a claim. Any false information you provide could be used against you if discovered later. This includes details regarding your address, age, health status, property value and so on. Remember, genuine mistakes can be corrected if pointed out in time, however intentional fabrications may lead to severe consequences.

Regularly Review Your Insurance Documents

Routine checking of your insurance documents can help in avoiding potential fraud. Make sure to review policies, premium notices, renewal statements and other related documents. This helps in ensuring the information is accurate, and any discrepancies can be clarified or rectified before they become problematic.

Avoid Signing Blank Insurance Claim Forms

Some fraudulent agents might request you to sign blank insurance forms, promising to fill them later on your behalf. Never comply with such requests as it leaves room for manipulation of information, which could result in fraudulent activity under your name. Always ensure that all forms are correctly filled and the information provided is accurate before signing any document.

Engage with Credible Insurance Professionals and Companies

Do thorough research before committing to any insurance agent or company. Check their licensing, read reviews from previous customers, and seek recommendations from trusted sources. Dealing with credible and reputed professionals will significantly reduce the risk of becoming a victim of insurance fraud.

Conclusion

In summary, it is essential to recognize the severe consequences that can result from lying to an insurance company. The negative outcomes, which encompass policy cancellations, denied claims, and potential legal ramifications, far outweigh any perceived advantages of dishonesty. It is, therefore, unequivocally advisable to prioritize truthfulness and transparency in all interactions with your insurance provider. By doing so, you not only safeguard your financial interests but also foster trust and reliability in your insurance relationships, ensuring a more favorable and secure insurance experience.

Insurance is a crucial aspect of financial planning and protection, and any attempt to deceive the insurer can jeopardize the very purpose of insurance coverage. Moreover, engaging in fraudulent activities can have long-lasting repercussions, affecting your ability to secure insurance in the future and even leading to legal consequences. Therefore, the most prudent course of action is to always uphold integrity and forthrightness when dealing with insurance matters, ultimately promoting a more stable and trustworthy insurance environment for all parties involved.

Look for an attorney who has the right legal resources for your legal needs.

Contact us here on the

Warmuth Law website or through our hotline 888-517-9888.

Frequently Asked Questions (FAQ's)

1. Can I correct false information on my insurance application?

Absolutely, it's crucial to promptly address any inaccuracies on your insurance application once you become aware of them. The first step is to contact your insurance company to inform them of the errors and request the necessary adjustments. Being proactive in rectifying these mistakes demonstrates your commitment to providing accurate information and can help avoid potential issues with your policy in the future.

2. What should I do if I've already lied on my application?

If you've already provided false information on your insurance application, it's imperative to act with honesty and integrity by admitting your mistake to your insurer as soon as possible. While it can be intimidating, coming clean is the best approach. Your insurance company may work with you to find solutions to rectify the situation, which could involve adjusting your policy or addressing any discrepancies. It's important to remember that ongoing deception can lead to more severe consequences, so addressing the issue promptly is in your best interest.

3. How can I lower my insurance premiums legally?

Instead of resorting to dishonesty, there are legitimate ways to reduce your insurance premiums. Exploring these options can help you save money while maintaining your integrity. Some strategies include bundling multiple insurance policies with the same provider, increasing your deductible (the amount you pay before insurance coverage kicks in), and working on improving your credit score. These approaches not only lower your premiums but also ensure you remain in compliance with insurance regulations and maintain a positive relationship with your insurer.

4. What is insurance fraud?

Insurance fraud encompasses any deliberate deception or misrepresentation made to an insurance company for financial gain. This unethical and illegal practice can take various forms, such as providing false information on applications, exaggerating claims, or staging

Personal Injury. Insurance fraud is a serious offense that can result in severe consequences, including

Criminal charges and the termination of insurance coverage.

5. Can insurance companies deny claims for honest mistakes?

Typically, insurance companies do not deny claims for honest mistakes made by policyholders. However, they may conduct an investigation to ascertain that the mistake was indeed unintentional and not part of any fraudulent activity. It's essential to be forthright with your insurer when reporting claims and to provide any necessary documentation to support your case. Honesty and transparency remain essential in ensuring that your legitimate claims are processed smoothly, without the risk of denial due to unintentional errors.