Understanding the Basics of Insurance

Understanding insurance might seem complex at first, but it’s crucial, especially when you face an accident or damage. This section aims to give you a better understanding of the basics in the world of insurance.

Definition of Insurance

Insurance is a contract, referred to as a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The company pools clients' risks to make payments more affordable for those insured.

The Principle of Indemnity

The principle of indemnity is at the heart of insurance and is designed to put you back in the same financial position you were in before the loss happened. It prevents the insurance holder from profiting from the insured event. In other words, if you get into a

Car Accident, your insurance covers the repairs, medical bills, etc., but doesn’t provide you with extra money beyond that.

Different Types of Insurance

There are numerous types of insurances available, each covering various incidents and scopes. Common types include auto, health, homeowners, and life insurance. Auto insurance, particularly important in the context of this article, protects you financially if you're in a

Car Accident. Different policies can offer different types of coverage, such as liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage.

Importance of Premiums, Deductibles, and Limits

When you purchase an insurance policy, you pay a premium to maintain your coverage. This amount can vary based on factors like your age, occupation, location, etc. A deductible is the amount you pay out of pocket before your insurance kicks in. The insurer will then cover costs up until your limit, which is the maximum amount your policy will pay for a covered loss.

Claiming Insurance

When an unfortunate event that your policy covers occurs, you'll file a claim with your insurance company. This is when you ask the insurer to compensate you for damages or to intervene on your behalf. Your insurance provider will investigate the incident and, based on their findings and your policy's terms, decide whether to approve or reject your claim.

Understanding these basics will enable you to navigate the insurance world more confidently, especially if there comes a time when you need to make a claim.

Types of Vehicle Insurance Policies

There are several types of vehicle insurance policies available, each providing unique types of coverage depending on the owner's needs. The three main types of insurance are liability coverage, collision coverage, and comprehensive coverage. Additional insurance policies include uninsured and underinsured motorist coverage, medical payments coverage, and

Personal Injury protection.

Liability Coverage

Liability coverage is the most basic form of vehicle insurance and is required by law in most states. This policy covers the costs resulting from the damage you cause to other people's property or personal injuries you cause in an accident. However, it doesn't cover your own damages or injuries. There are two types: bodily injury liability and property damage liability.

Collision Coverage

Collision coverage pays for the repair or replacement of your vehicle if you're involved in an accident with another vehicle or if you hit an inanimate object, like a tree or a fence. It applies regardless of who is at fault. The policyholder must pay a deductible before the coverage can kick in.

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your car that's not related to collisions. This includes events such as theft, vandalism, natural disasters, fire, or damage from animals. Like collision coverage, a deductible applies.

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protect you when you’re hit by a driver who has no insurance or not enough insurance to cover your damages. Some jurisdictions require drivers to carry this type of coverage.

Medical Payments Coverage and Personal Injury Protection

Medical payments coverage and

Personal Injury protection (PIP) help pay for medical expenses for you and your passengers after an accident. PIP goes beyond medical payments coverage by covering associated costs such as lost wages or childcare. Requirements for these coverages vary from state to state.

What to Do Immediately After the Incident

After an unfortunate incident like a

Car Accident, you might be shocked and disoriented. However, it's important to maintain composure and take the following steps immediately.

Ensure Safety First

The very first thing to do after being hit is to ensure your safety and that of any passengers you may have. If it's safe to do so, move the vehicle off the road to prevent further accidents. Switch on your hazard lights and use safety cones or flares if you have them.

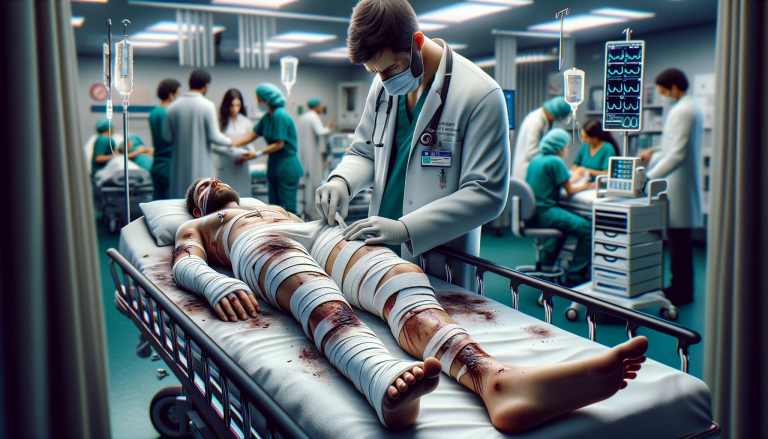

Get Medical Help

Even if you feel fine after the accident, it's essential to get a medical checkup. Some injuries, especially those related to trauma or whiplash, don't show immediate symptoms. Remember to keep all medical records and bills, as these can serve as evidence when you claim your insurance.

Contact Law Enforcement

In most jurisdictions, it's necessary to report a traffic accident to law enforcement. The police will document the scene, interview witnesses, and eventually file a report. This official report can be useful when dealing with your insurance company, so ensure you obtain a copy.

Document the Incident

Use your smartphone to take pictures of the scene, including your vehicle, other vehicles involved, and any visible injuries. Write down key details of the incident as you remember them. These details could include the date, time, location, weather conditions, and any notable events leading up to the accident.

Exchange Information and Notify Your Insurance Provider

Exchange contact and insurance information with the other driver involved in the accident. Remember not to admit any fault or sign any documents except for those from law enforcement. After leaving the scene, contact your insurance provider as soon as possible. They will give you further instructions on how to submit a claim and what other information they need.

Reporting the Incident to Your Insurance Provider

Initiating Contact with Your Insurance Provider

When you have been hit, the first thing to do is contact your insurance provider. This can often be done via a phone call, online, or through a mobile app if your insurer provides one. It's best to report the incident as soon as possible, giving a comprehensive account of what happened. Be sure to document the time, place, related injuries, and any other relevant details.

Gathering Necessary Documentation

To facilitate the reporting process, make sure to gather and provide all the necessary documentation. This should include photos of the incident scene, the damage sustained by your vehicle, and any injuries incurred. If the police were involved, it would be beneficial to obtain a copy of their report. Any eyewitness testimonies or camera footage from nearby security cameras can also be useful.

Understanding Your Policy Coverage

Before initiating the claim, familiarize yourself with your policy coverage. What does it cover? Are there deductibles? Understanding these factors will give you an idea of what to expect in terms of repair costs and medical bills. This awareness will also help facilitate communication with your insurance provider when discussing the claim handling process.

Conducting Follow-ups with Your Insurance Provider

Once you've reported the incident and submitted the claim, keep in touch with your insurance company. Regularly follow up to ensure the claim is being processed in a timely manner. The insurance company might need more information or documentation from you during this period, for which you need to be readily available.

Filing a Third-Party Claim

If the other party was at fault, you might have to file a third-party claim against their insurance company. In this scenario, understanding the terms of the other party’s insurance policy, how it works, and what it covers becomes crucial. Your insurance company can guide you on how to proceed with a third-party claim.

How Insurance Companies Determine Fault

The Process of Accident Analysis

Insurance companies conduct a detailed investigation whenever a claim is made. They start with the accident report filed by the police, take into account any photographs taken at the scene, and consider witness testimonies if available. Each piece of information provides a clearer picture of how the incident unfolded. Where there is ambiguity or dispute, insurance adjusters may also rely on local traffic laws to better understand who may be at fault.

The Role of State Laws

Ultimately, how fault is determined can be largely influenced by the specific laws prevailing in your state. Some states follow 'At-fault' or 'Tort' system where the person causing the accident pays for the damages. In contrast, others follow a 'No-fault' system where each party's own insurance pays for their losses, regardless of who caused the accident. However, even in 'No-fault' states, serious accidents may still result in lawsuits to determine fault.

Understanding Comparative and Contributory Negligence

Two key legal concepts often applied when determining fault are comparative negligence and contributory negligence. Comparative negligence allows fault to be distributed among parties involved based on their percentage of responsibility in the accident, whereas contributory negligence bars any recovery if you were even slightly negligent (or at fault). The insurance company will rely on these principles, coupled with the state laws, to make their final determination.

The Application of the Duty of Care Concept

Another essential element insurance companies use to establish fault is the concept of the duty of care. Essentially, this means all drivers have an obligation to act responsibly on the road. If it can be demonstrated that a driver has breached their duty of care - either through distraction, inebriation, reckless driving, or other actions - they can be deemed at fault.

Disputing Fault Determination

Once an insurance company has assigned fault, it's not the end of the road. If you disagree with their assessment, you have the right to challenge it. This might involve presenting additional evidence or seeking legal advice. Remember, the degree of your fault directly impacts the claim payout amount, so it's worth ensuring the determination is as accurate as possible.

Understanding Coverage and Claim Process

Breaking Down Insurance Coverage

Insurance coverage is essentially a financial safeguard for potential future losses or damages. When you hold an insurance policy, the insurance company pledges to pay, up to a specified limit, for losses outlined in the policy. There are various types of insurance coverage, but when it comes to accidents, your auto insurance policy generally provides coverage for property damage liability and bodily injury liability. This means that if someone else hits you, their insurance should cover your damages.

The Role of Your Insurance Company

In case of an accident, your insurance company plays a pivotal role. If another driver hits you and they carry no insurance or inadequate coverage, your uninsured/underinsured motorist coverage steps in. Furthermore, even where the other party is insured, your insurance company often initially covers your damages minus any deductibles, then seeks reimbursement from the other party's insurance company through a process known as subrogation.

The Claim Filing Process

To benefit from your insurance cover, filing a claim is necessary. The claim process begins immediately after the accident. It starts with notifying your insurance company about the accident, providing them with necessary information about the incident. This includes details like where the accident occurred, how it happened, who was involved, and the extent of injuries and/or damages.

Investigation and Settlement of Claim

Once a claim is filed, your insurance company assigns a claims adjuster who investigates the accident, reviews the policy to determine coverage, and estimates the cost of repairs or medical treatments. After the investigation, the insurer will then validate or deny the claim based on the gathered facts. If validated, the adjuster negotiates the settlement amount between you and the insurer or other party's insurer.

Understanding the Claim Dispute Resolution Process

Sometimes, disputes may arise concerning the claim amount proposed by the insurance company. If this happens, the dispute resolution process begins. This involves a series of negotiations between the claimant and the insurance company to reach an agreeable settlement. If the dispute can't be resolved amicably, it may proceed to litigation where a court makes the final decision based on the evidence presented.

Dealing with Uninsured or Underinsured Drivers

Understanding Uninsured and Underinsured Drivers

Despite laws requiring insurance in most states, some drivers still operate their vehicles without adequate coverage. Being uninsured means having no insurance at all. On the other hand, being underinsured refers to drivers who have some insurance coverage but not enough to cover a victim's losses after an auto accident.

Your Own Insurance Coverage

If you're hit by an uninsured or underinsured driver, your first line of defense is usually your own auto insurance policy. Collision coverage can help pay for damage to your vehicle, while medical payments coverage or

Personal Injury protection (if available in your state) can assist with the costs of any injuries you sustain. It's important to regularly review and understand your own policy to assure you're adequately covered in these situations.

Involving Uninsured/Underinsured Motorist Coverage

Beyond your standard policy, you may have or want to consider adding Uninsured/Underinsured Motorist Coverage. This add-on is specifically designed to protect you when involved in an accident with a driver lacking sufficient insurance. It helps cover costs that exceed the other driver's policy limits or lack thereof.

Legal Actions Against Uninsured or Underinsured Drivers

In some cases, it might be necessary to take legal action against the uninsured or underinsured driver. You can sue for damages, though this process can be long and complicated. Plus, if the driver doesn’t have insurance, they may not have enough assets to cover your damages, making the legal efforts futile. Consulting a lawyer in such situations can give you a better understanding of your options.

The Role of State Laws

State laws also play a critical role when dealing with uninsured and underinsured drivers. Some states follow a 'no-fault' system where your own insurance company pays for medical expenses and lost income regardless of who caused the accident. Other states require uninsured motorist coverage as part of all auto insurance policies. It's essential to understand the laws in your state to better navigate these situations.

Conclusion

In conclusion, having a clear understanding of how insurance functions when you're involved in an accident is paramount for safeguarding both your financial stability and physical health. Insurance policies come in various types, each designed to provide coverage for different situations and scenarios. Whether it's auto insurance, health insurance, or property insurance, knowing the specifics of your coverage is crucial. Equally important is comprehending the intricacies of the claims process, which can differ significantly from one type of insurance to another. By staying well-informed about your insurance policy and being aware of the steps involved in filing a claim, you can be better prepared to navigate the aftermath of an accident.

Furthermore, proper documentation of the incident is a critical step in the insurance process. This documentation serves as a vital record of the event and the damages incurred, helping to substantiate your claim. Timeliness is another key factor, as reporting the incident promptly to your insurance provider ensures that the claims process begins without unnecessary delays. By following these essential steps, you not only maximize your chances of receiving the coverage you're entitled to but also contribute to a smoother and more efficient resolution of the situation. In a world where unexpected accidents can happen, being well-versed in insurance procedures is a proactive way to protect your financial and physical well-being.

Look for an attorney who has the right legal resources for your legal needs.

Contact us here on the

Warmuth Law website or through our hotline 888-517-9888.

Frequently Asked Questions (FAQ's)

1. Is health insurance enough to cover all medical expenses if I get hit?

Health insurance is a valuable resource that covers a significant portion of your medical expenses. However, it's crucial to review your policy for any potential limitations, such as specific treatments or medications that may not be fully covered. Additionally, many health insurance plans come with deductibles and copayments, which means you'll still be responsible for a portion of the costs. To ensure you understand the extent of your coverage, carefully read your policy and consider supplemental insurance options if necessary, such as disability or accident insurance, to further protect your financial well-being in the event of an accident.

2. What if I don't have health insurance?

If you don't have health insurance, you can still receive medical treatment, but you will be personally responsible for covering the entirety of your medical expenses. This can potentially lead to a significant financial burden. To mitigate this risk, it's advisable to explore health insurance options that suit your needs and budget. The Affordable Care Act (ACA) in the United States provides avenues for obtaining health coverage, including Medicaid and Health Insurance Marketplaces. Obtaining health insurance is not only a wise financial decision but also crucial for your long-term well-being, as it ensures you have access to necessary medical care when accidents or illnesses occur.

3. Can I choose my own doctor after getting hit?

In most cases, you have the freedom to choose your own doctor for medical treatment after an accident. However, it's wise to consult with your health insurance provider or review your policy to understand any network restrictions or preferred providers. Some insurance plans may offer lower costs or higher coverage for services obtained from in-network healthcare providers. Still, you generally have the option to seek care from the healthcare professional you trust the most, as long as they accept your insurance or you are willing to cover any additional out-of-network costs.

4. hat if the person who hit me doesn't have insurance?

If the at-fault party in the accident doesn't have insurance (uninsured), you may face challenges in seeking compensation for your injuries and damages. In such cases, you may need to rely on your own insurance coverage, such as uninsured motorist coverage or

Personal Injury protection (PIP), if you have these options in your policy. Alternatively, you may need to take legal action against the at-fault party to seek compensation, although recovery may be limited if the responsible party lacks insurance or sufficient assets. To protect yourself, consider discussing uninsured motorist coverage with your insurance provider to ensure you have adequate protection in case you are involved in an accident with an uninsured driver.

5. How can I prevent insurance disputes after an accident?

To minimize the likelihood of insurance disputes after an accident, it's crucial to follow a few key steps. First, document the incident thoroughly by taking photographs of the scene, your injuries, and any damages to vehicles or property involved. Collect contact information from witnesses and exchange information with the other parties involved. Second, communicate promptly and honestly with your insurance company, providing them with all the necessary information and documentation. Keep a record of all communication with your insurer for reference. Lastly, if you encounter difficulties or disputes with your insurance company, consider seeking legal advice from an attorney experienced in insurance claims. Legal representation can help protect your rights and ensure you receive the compensation you deserve, should disputes arise during the claims process.