Understanding Insurance Coverage

The Nature of Insurance Coverage

Insurance coverage is a contract in which one party, the insurance company, agrees to compensate another, the policyholder, for specified loss, damage, illness, or death, in return for payment of a certain premium. It serves as a safety net, offering financial protection against unexpected events that can cause significant economic harm.

Different Types of Insurance Coverage

Various types of insurance policies have been designed to cover different kinds of expenses. The most common ones are health insurance, life insurance, auto insurance, home insurance, and travel insurance. Each type offers distinctive coverage. For instance, health insurance primarily covers medical bills while auto insurance is meant to take care of expenses related to vehicle damages or injuries caused by

Automobile accidents.

Parameters of Insurance Coverage

The extent to which an insurance policy covers expenses depends on its terms and conditions. These parameters may include deductibles, copayments, out-of-pocket limits, excluded services, and coverage limits. Understanding these factors is crucial in determining what expenses will be covered by the insurance company.

How Claims Work

To avail the benefits of an insurance policy, a claim must be filed with the insurer who then evaluates it. If approved, the insurer pays the claim based on the policy's coverage. It's important to understand the claim process, as failure to correctly file a claim often results in a rejection or diminished payout.

Knowing Your Policy

It’s essential to familiarize oneself with the insurance policy document because it provides detailed information about the coverage. Reading and understanding the insurance policy helps the policyholder make informed decisions and avoid unpleasant surprises when making a claim. Consulting with the insurance agent or broker can also be beneficial for clarification of any complex terms or conditions.

Types of Insurance Coverages

Auto Insurance Coverage

Auto insurance coverage is a broad category that covers various costs, including medical expenses, property damage, and liability costs. Comprehensive coverage pays for damages due to theft or natural disasters, collision coverage helps pay for vehicle repairs, and liability insurance covers legal concerns if you're held responsible for an

Accident. It might also extend to cover the costs of a rental car while your vehicle undergoes repairs.

Household or Homeowners Insurance

Homeowners insurance is designed to protect against various risks associated with owning a home. This includes not only the physical structure but also personal possessions inside the house. If your home becomes uninhabitable due to a covered event, like a fire or flooding, this policy can also cover your additional living expenses. Liability protection is another critical component of homeowners insurance, providing coverage if someone gets injured on your property.

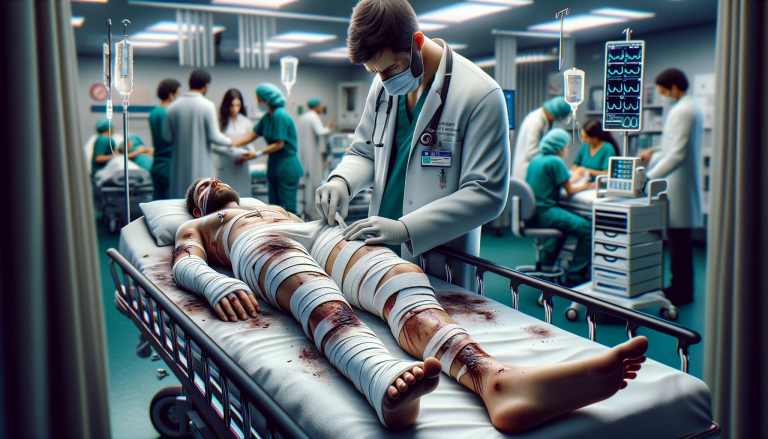

Health Insurance Coverage

Health insurance essentially covers medical, surgical, prescription drugs, and sometimes dental expenses. Coverage varies widely depending on the specific policy but generally includes routine check-ups, hospital stays, surgeries, and mental health services. Many health insurance policies also provide coverage for prescription medications and rehabilitative services.

Life Insurance Policies

Life insurance policies provide a death benefit to beneficiaries upon the policyholder's death. The funds can be used to cover funeral expenses, outstanding debts, or provide financial support to dependents of the policyholder. Some life insurance policies also build up a cash value over time, which the policyholder can borrow against or even cash out during their lifetime.

Business Insurance Protection

Business insurance policies cover a wide range of expenses to protect businesses from potential risks. Property insurance protects business-owned properties and assets against damage or theft; liability insurance covers legal costs if the business is sued; workers' compensation insurance handles costs related to employee injuries at work. Other specialized coverages, like business interruption insurance, can cover loss of income due to a disaster that interrupts normal business operations.

Insurance Coverage for Health Expenses

Understanding Health Insurance Coverage

Health insurance coverage operates to protect policy holders from high or unexpected health-care costs. Generally, insurance companies pay all or a part of your health expenses, contingent on the specific terms of your policy. This can encompass routine check-ups, preventive care, hospital stays, surgeries, prescription drugs, and more. The range of what is covered will vary depending on your individual plan or insurer.

Outpatient and Inpatient Care

Two key components of health insurance coverage are outpatient and inpatient care. Outpatient care refers to medical treatments or tests that can be done without an overnight stay at a healthcare facility. These can include doctor's visits, lab tests, or same-day surgeries. Conversely, inpatient care typically involves a hospital stay of one night or more. Services such as surgeries, intensive care, diagnostic tests, and other treatments can fall under this category.

Prescription Drugs and Mental Health Services

Prescription drug coverage is a standard feature of most health insurance plans, helping to reduce the out-of-pocket cost for necessary medications. Some plans may have a list of approved drugs, while others may cover drugs on a case-by-case basis. Mental health services, including counseling and psychotherapy, are also generally included in health insurance plans. Furthermore, many insurers now offer coverage for telehealth services, allowing patients to seek medical or mental health advice remotely.

Preventive and Rehabilitative Services

Preventive services like immunizations, screenings, and check-ups are usually covered by health insurance plans. By promoting prevention and early detection of diseases, these services help to ward off more serious, costly health issues down the line. Rehabilitative services, which assist individuals recover skills lost due to

Injury, disability, or chronic conditions, are typically included in insurance coverage as well.

Understanding Restrictions and Exclusions

While health insurance coverage is comprehensive, it's important to understand that some services or treatments may not be covered. These can include alternative therapies, cosmetic surgery, and any procedures deemed not medically necessary. Understanding the specifics of your policy, including any restrictions or exclusions, will help you better navigate your health expenses and reduce any unexpected out-of-pocket costs.

Insurance Coverage for Auto Expenses

Understanding Auto Insurance Coverage

Auto insurance coverage is a contract between you and your insurance company, where you pay a premium and in return, the company promises to pay for specific car-related financial losses within the agreed term. The coverage extends to different areas making it necessary to understand which sections are covered under the policy.

Comprehensive Coverage

Comprehensive cover forms a crucial part of auto insurance. It protects you against damages to your car that aren't caused by a collision, such as theft, vandalism, fire, natural disasters like floods and earthquakes, or hitting an animal. Policies with comprehensive coverage generally include a deductible, which is the amount you'd have to pay before your insurer covers the remaining amount.

Collision Coverage

Collision coverage comes into play when your car is damaged due to a collision with another vehicle or object, regardless of who's at fault. Like comprehensive coverage, collision coverage generally includes a deductible. Although not required by every state, it is a typical requirement if you're leasing or financing your car.

Liability Coverage

Liability coverage is legally required in most states. It is designed to cover the costs associated with injuries to others or damage to their property that you're responsible for due to an accident. This coverage is often split into two categories:

Bodily Injury (BI) and Property Damage (PD). BI covers the cost of injuries to others that you're responsible for, while PD covers the cost of damage to others' property.

Medical Payments and Personal Injury Protection

Medical Payments (MedPay) and

Personal Injury Protection (PIP) pay for immediate and necessary medical services following a car accident that results in injury. In addition to medical expenses, PIP may also cover lost wages and funeral costs. Coverage varies greatly by policy and state, but these are generally available regardless of who's at fault in an accident.

Remember, the aforementioned are standard coverages found in most auto insurance policies. However, insurers also offer additional coverages like Roadside Assistance, Rental Reimbursement, and Gap Coverage for added protection. Be sure to thoroughly review your policy offerings with your agent to ensure you understand all coverages available to you.

Insurance Coverage for Home Expenses

Understanding the Basics of Home Insurance Cover

Home insurance coverage is typically designed to offer financial protection against losses due to disasters, theft, and accidents that may occur in a private residence. It usually covers four types of incidents on the insured property: interior damage, exterior damage, personal property loss or damage, and injury that occurs on the property. The specific kinds of risks covered are outlined within the insurance policy.

Details on Dwelling Coverage

Dwelling coverage or "Coverage A," as it's often referred to, is a significant component of a homeowner's insurance policy. It helps pay for repairing or rebuilding your home if it's damaged due to a covered cause of loss like fire, lightning, hail, or vandalism. This does not just cover the structure of the house but also attached structures like garages or decks.

Personal Property and Contents Coverage

Personal property coverage, often termed as "Coverage C," provides protection for the contents of your home and your personal belongings. This could include furniture, clothing, appliances, electronics, and more. If these items are stolen, damaged, or destroyed in a covered event, your insurance policy will help replace them.

Loss of Use and Additional Living Expense Insurance

Should your home become uninhabitable due to a covered loss, loss of use, or additional living expense (ALE) coverage can help. This insurance helps cover the increased living costs incurred while your home is being repaired or rebuilt, such as hotel bills, restaurant meals, and other living expenses.

Liability Protection Coverage

Liability coverage protects you if you or other family members accidentally cause bodily injury or property damage to others. It does this by covering the cost of your legal defense and any settlement or award should you be legally responsible. Liability coverage is often part of a standard home insurance policy.

Insurance Coverage for Travel Expenses

Understanding Travel Insurance

Travel insurance is a specific type of insurance that provides coverage for various unforeseen situations related to traveling. This includes trip cancellation, medical emergencies, travel delays, and lost luggage. It's crucial to comprehend your policy and the specific types of expenses it covers before you embark on your journey.

Medical Emergencies and Evacuation

One of the primary aspects of travel insurance coverage is related to medical emergencies. If an insured individual falls sick or gets injured during the trip, the insurance will cover their medical expenses. Coverage typically includes hospital stays, surgery, and emergency medical evacuation if the insurer determines that the necessary treatment isn't available locally.

Travel Interruptions and Cancellations

Travel insurance often includes coverage for trip interruptions and cancellations. Should certain unexpected events such as sudden illness, bad weather, or a death in the family occur, causing you to cancel your trip, you may be reimbursed for non-refundable expenses. Likewise, if your trip is interrupted for similar reasons, you will be covered for the additional travel costs.

Baggage Loss or Delay

Another common provision within travel insurance policies is coverage for lost, stolen, or delayed baggage. The insurance company will reimburse you for replacing essential items in your luggage, should it be delayed. For lost or stolen luggage, the insurer will compensate you up to a certain limit defined in the policy.

Travel Delays

Some travel insurance coverage extends to include travel delays due to circumstances outside of your control, such as adverse weather conditions, terrorism or strike actions. This can include the costs of accommodation, meals, and alternative travel arrangements.

Always remember to thoroughly review your policy document to understand the extent of your coverage for travel expenses. Each insurance company has its own terms and conditions, so it's essential to know what is specifically covered by your policy.

Limitations and Exclusions in Insurance Coverage

Understanding Exclusions in Insurance Policies

The exclusions are specific circumstances or contingencies that your insurance policy does not cover. It is imperative to read through these carefully at the time of buying an insurance policy to avoid confusion and disputes at a later stage. Common examples of exclusions include pre-existing medical conditions, damage caused by natural disasters, and instances where an insured party engages in illegal activities.

Limitations on Covered Expenses

Even if an expense is covered under an insurance policy, there may be certain limitations on how much the insurer is willing to pay. This could be in the form of co-payments, deductibles, or maximum payout limits which are specified in the policy contract. For instance, a health insurance policy might have a limitation on the total cost it covers for certain surgeries or medical treatments.

Case-by-case Limitations and Exclusions

There could be limitations applied on the basis of individual cases or situational factors. These could be based on the risk assessment of the insured individual or items. For example, a car insurance company might refuse to cover damages if the vehicle was being driven by an unlicensed driver at the time of the

Accident.

Policy Terms and Conditions

Often, limitations and exclusions are articulated clearly in the policy's terms and conditions. It's here where the details about what’s specifically covered and what’s not, are mentioned. For example, a travel insurance plan may not cover any cancellations made less than 48 hours before departure.

The Impact of Claim History

Your past claim history can influence the extent of coverage your insurer offers you. If a policyholder has a high incidence of claims, the insurance company may enforce certain limitations or exclusions as a means to mitigate their risk. This could include higher premiums, refusal to renew the policy, or specific exclusions on certain types of coverage.

Conclusion

Insurance companies typically cover a range of expenses depending on the type of insurance policy. Common expenses covered by insurance may include medical costs, property damage, liability claims, and more. It's important for policyholders to review their insurance policy to understand what specific expenses are covered.

Look for an attorney who has the right legal resources for your legal needs.

Contact us here on the

Warmuth Law website or through our hotline 888-517-9888.

Frequently Asked Questions (FAQ's)

1. What medical expenses does the insurance company cover?

Insurance companies may cover a variety of medical expenses, including doctor visits, hospital stays, surgeries, prescription medications, and medical tests.

2. Does insurance cover property damage?

Yes, insurance policies often cover property damage caused by covered perils such as fire, theft, vandalism, or natural disasters. The extent of coverage depends on the policy terms and limits.

3. Are liability claims covered by insurance?

Yes, liability insurance typically covers legal expenses, settlements, and judgments if you are sued for

Bodily injury or property damage that you are responsible for.

4. Does insurance cover rental car expenses?

Some insurance policies offer coverage for rental car expenses if your car is being repaired due to a covered loss. This coverage is typically included in comprehensive and collision policies.

5. Are there any expenses that insurance does not cover?

Yes, there are often exclusions in insurance policies that specify what expenses are not covered. Common exclusions may include intentional acts, pre-existing conditions, and certain types of high-risk activities.