Road Rules: Essential Car Insurance Terms for Navigating Auto Accident Claims

Introduction

Navigating the world of car insurance can feel like learning a new language, especially when you're dealing with the aftermath of an auto accident. Understanding the essential car insurance terms can make the process of filing a claim smoother and less stressful. This article will break down the key terms you need to know to handle

Auto accident claims effectively.

Basic Car Insurance Terms

Premium

The premium is the amount you pay to your insurance company to maintain your car insurance policy. This can be paid monthly, quarterly, or annually. Your premium amount is determined by various factors including your driving record, age, location, and the type of car you drive.

Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your

Accident results in $3,000 worth of damage, you will pay $500, and your insurance will cover the remaining $2,500.

Policyholder

The policyholder is the individual who owns the insurance policy. This person is responsible for paying the premiums and is entitled to the benefits and coverage specified in the policy.

Coverage Types

Liability Coverage

Liability coverage is a fundamental part of any car insurance policy. It protects you from financial loss if you are found legally responsible for causing damage or injury to others. Without liability coverage, you could face significant out-of-pocket expenses for legal fees, medical bills, and property damage. There are two main types of liability coverage:

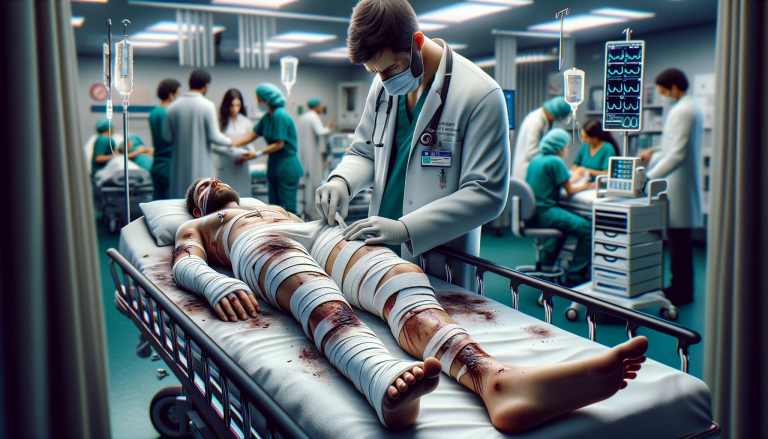

Bodily injury liability coverage pays for injuries that you cause to other people in an accident. This can include drivers, passengers, pedestrians, and cyclists. The coverage helps pay for their medical expenses, such as hospital stays, surgeries, and rehabilitation. It can also cover lost wages if the injured person is unable to work due to their injuries. Additionally, if the injured party decides to sue you, bodily injury liability can help cover your legal defense costs and any settlements or judgments against you.

Property Damage Liability

Property damage liability coverage pays for damage you cause to someone else's property while driving. This can include damage to other vehicles, buildings, fences, and other structures. For example, if you Accidentally crash into someone's car or run into a mailbox, your property damage liability coverage will pay for the repairs or replacement costs. This type of coverage ensures that you won't have to pay out-of-pocket for the damage you cause to others' property, which can be very expensive.

Collision Coverage

Collision coverage pays for damage to your car resulting from a collision with another vehicle or object, regardless of who is at fault. This type of coverage is particularly important if you have a newer or more expensive car, as repair costs can be significant. Collision coverage helps cover the cost of repairs or even the replacement of your car if it is deemed a total loss. For example, if you collide with another car, hit a tree, or roll your vehicle, collision coverage will help pay for the damages to your vehicle.

Comprehensive Coverage

Comprehensive coverage pays for damage to your car caused by events other than collisions. This can include a wide range of incidents such as theft, vandalism, natural disasters (like floods, hurricanes, and earthquakes), fire, and damage from hitting an animal. Comprehensive coverage provides peace of mind knowing that your vehicle is protected against various risks that can occur even when you're not driving. For example, if a tree falls on your car during a storm or if your car is stolen or vandalized, comprehensive coverage will help pay for the repair or replacement of your vehicle.

Claims Process Terms

Claim

A claim is a formal request made to your insurance company for payment based on the terms of your policy. When you file a claim, you are asking your insurer to cover the costs associated with an

Accident or other covered event, such as theft or natural disaster. The claims process involves providing detailed information about the incident, including the date, time, location, and a description of what happened. You may also need to submit supporting documentation, such as police reports, medical bills, and repair estimates. Once your claim is filed, the insurance company will review it and determine whether the event is covered under your policy and what amount, if any, they will pay.

Adjuster

An adjuster is a representative from your insurance company who investigates the details of your claim. Their role is to assess the damage, determine the payout amount, and help facilitate the claims process. Adjusters may inspect your vehicle, review repair estimates, and interview witnesses or involved parties. They act as a liaison between you and the insurance company, ensuring that your claim is processed fairly and efficiently. Adjusters are crucial in determining the extent of the insurance company's liability and the appropriate compensation for your loss. They may also negotiate settlements and ensure that repairs or replacements are carried out to your satisfaction.

Total Loss

A total loss occurs when the cost to repair your car exceeds its actual cash value (ACV). This can happen in cases of severe damage where repairs are not economically feasible. When your car is deemed a total loss, the insurance company will pay you the market value of your vehicle rather than covering the repair costs. The ACV is determined based on factors like the car's age, mileage, condition, and comparable sales in your area. Once declared a total loss, you may need to sign over the car's title to the insurance company, who may then sell the car for salvage. Understanding total loss procedures ensures you receive fair compensation and can plan your next steps, whether purchasing a new vehicle or otherwise.

Additional Coverage Options

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. This coverage is essential because not all drivers carry adequate insurance, and without it, you could be left paying for significant out-of-pocket expenses. Uninsured motorist coverage can pay for your medical expenses, lost wages, pain and suffering, and vehicle repairs. Underinsured motorist coverage kicks in when the at-fault driver's insurance is not enough to cover all your damages, making up the difference between their coverage and the actual costs.

Personal Injury Protection (PIP) is a type of no-fault insurance that covers medical expenses and, in some cases, lost wages and other damages, regardless of who is at fault in the accident. PIP is designed to ensure that you receive timely medical treatment and financial support following an accident. It can cover a wide range of expenses, including hospital visits, surgeries, rehabilitation, and even funeral costs. In addition to medical expenses, PIP may cover lost income if your injuries prevent you from working, as well as essential services you can no longer perform due to your injuries, such as childcare or housecleaning.

Medical Payments Coverage

Medical payments coverage pays for medical expenses for you and your passengers after an accident, regardless of fault. This type of coverage can be particularly valuable in covering immediate medical costs and supplementing other insurance you may have. Medical payments coverage can include hospital visits, surgery, X-rays, ambulance fees, and other necessary medical treatments. Unlike PIP, medical payments coverage does not typically cover lost wages or other non-medical expenses. It's a straightforward way to ensure that you and your passengers receive prompt medical care without worrying about who was at fault in the accident.

Policy Limits and Exclusions

Policy Limits

Policy limits are the maximum amounts your insurance company will pay for a covered claim. These limits define the extent of your coverage and can significantly impact your out-of-pocket expenses in the event of an accident. Policy limits are typically divided into three categories:

- Per Person: This is the maximum amount your insurance will pay for injuries to a single person in an accident.

- Per Accident: This is the total maximum amount your insurance will pay for all injuries in a single accident, regardless of the number of people injured.

- Property Damage: This is the maximum amount your insurance will pay for damage to property resulting from an accident.

For example, if you have a policy with limits of $50,000 per person, $100,000 per accident, and $25,000 for property damage, your insurance would cover up to $50,000 for any one person’s injuries, up to $100,000 total for all injuries in the accident, and up to $25,000 for property damage. It’s important to choose policy limits that provide adequate protection based on your assets and potential risks, as any costs exceeding these limits would be your responsibility.

Exclusions

Exclusions are specific situations or circumstances that are not covered by your insurance policy. These are outlined in your policy documents and are critical to understand, as they define the boundaries of your coverage. Common exclusions include:

- Intentional Damage: Any damage you intentionally cause to your vehicle or another's property is not covered.

- Commercial Use: Using your personal vehicle for commercial purposes, such as ride-sharing or delivery services, is often excluded unless you have specific commercial auto insurance.

- Driving Under the Influence (DUI): Accidents that occur while you are driving under the influence of drugs or alcohol are typically not covered.

- Racing: Participating in any form of organized racing or speed contests with your vehicle is usually excluded.

- War or Terrorism: Damages resulting from acts of war or terrorism are often not covered.

Understanding exclusions helps you avoid situations where you might be left without coverage and ensures you can take appropriate measures, such as purchasing additional insurance if necessary.

Discounts and Benefits

Safe Driver Discount

Many insurance companies offer discounts to drivers who maintain a clean driving record over a certain period. This is known as a safe driver discount. It rewards drivers for avoiding accidents and traffic violations, which indicates a lower risk of future claims. To qualify, you generally need to have no at-fault accidents, traffic tickets, or major violations for a specified number of years. Safe driver discounts can significantly reduce your premium, making it a valuable benefit for responsible drivers.

Multi-Policy Discount

If you have more than one type of insurance policy with the same company, such as home and auto insurance, you may qualify for a multi-policy discount. This discount, also known as bundling, provides savings because it simplifies the insurance company’s operations and increases their business with you. For example, combining your homeowner’s, auto, and life insurance policies with a single provider can lead to substantial discounts on each policy. Bundling not only saves money but also adds convenience by having all your insurance needs managed by one company.

Good Student Discount

Insurance companies often offer discounts to students who maintain good grades. This is because statistically, good students tend to be safer drivers. Typically, to qualify for a good student discount, you must be a full-time high school or college student and maintain a grade point average (GPA) of 3.0 (B average) or higher. Some insurers may also accept placement on the honor roll or Dean’s List. This discount recognizes the lower risk associated with students who demonstrate responsibility and discipline in their studies, potentially lowering the cost of insurance for young drivers.

By taking advantage of these discounts and understanding your policy's limits and exclusions, you can optimize your car insurance coverage and save money while ensuring you have the necessary protection.

Renewal and Cancellation Terms

Renewal

Renewal refers to the continuation of your insurance policy for another term after the current term expires. Typically, an insurance policy term lasts for six months or one year. Before the term ends, your insurance company will send you a renewal notice. This notice will include the new premium amount, which may change based on various factors such as your driving record, changes in risk, or adjustments in the insurance market.

The renewal process ensures that you maintain continuous coverage without any gaps. To renew your policy, you generally need to review the renewal notice, confirm that all information is accurate, and pay the new premium by the specified due date. It's also a good time to reassess your coverage needs and make any necessary adjustments to your policy, such as adding new drivers or vehicles, or changing coverage limits.

Lapse

A lapse occurs when your insurance coverage expires because you did not pay the premium by the due date. Driving without insurance is illegal in most states and can result in severe consequences, including fines, license suspension, and increased premiums when you do obtain insurance again. A lapse in coverage can also leave you financially vulnerable in the event of an accident, as you would be personally responsible for any damages or injuries you cause.

To avoid a lapse, it’s important to pay your premium on time and keep track of renewal dates. Many insurance companies offer automatic payment options to ensure that your premium is paid on time, reducing the risk of an unintentional lapse. If you do experience a lapse, it's crucial to reinstate your coverage as soon as possible to avoid legal and financial penalties.

Cancellation

Cancellation is when you or your insurance company terminate your policy before its expiration date. There are various reasons why a policy might be canceled, including:

- Non-Payment of Premiums: If you fail to pay your insurance premiums on time, your insurer may cancel your policy.

- Fraud: Providing false information or engaging in fraudulent activities can lead to cancellation.

- Changes in Risk Factors: Significant changes in your risk profile, such as multiple traffic violations, major accidents, or changes in the use of your vehicle (e.g., from personal to commercial use), can prompt your insurer to cancel your policy.

When your insurance company cancels your policy, they are required to provide you with a notice of cancellation, explaining the reason and the effective date of the cancellation. As a policyholder, you also have the right to cancel your policy at any time, typically with written notice. However, it's important to ensure that you have a new policy in place before canceling your current one to avoid a lapse in coverage.

Understanding the terms of renewal, lapse, and cancellation helps you maintain continuous coverage and stay in compliance with legal requirements. It also allows you to manage your insurance policy effectively, ensuring that you have the necessary protection when you need it most.

Conclusion

Understanding these essential car insurance terms can significantly help you navigate the claims process after an

Auto accident. Being well-informed not only ensures that you get the coverage you're entitled to but also helps you make better decisions regarding your insurance needs. Stay informed and drive safely!

Look for an attorney who has the right legal resources for your legal needs.

Contact us here on the

Warmuth Law website or through our hotline 888-517-9888.

Frequently Asked Questions(FAQ's)

1. What is the difference between comprehensive and collision coverage?

Comprehensive coverage pays for damage to your car from non-collision events like theft, vandalism, or natural disasters. Collision coverage, on the other hand, pays for damage resulting from a collision with another vehicle or object.

2. How do policy limits affect my coverage?

Policy limits are the maximum amounts your insurer will pay for a covered claim. If your damages exceed these limits, you will be responsible for the remaining costs out of pocket.

3. What should I do immediately after an accident?

Immediately after an accident, ensure everyone's safety, call the police, exchange information with the other driver, and document the scene with photos. Then, contact your insurance company to start the claims process.

4. How can I lower my car insurance premium?

You can lower your premium by maintaining a clean driving record, bundling policies, taking advantage of discounts, and choosing a higher deductible. Shopping around for better rates can also help.

5. What is the role of an insurance adjuster?

An insurance adjuster investigates the details of your claim, assesses the damage, and determines the payout amount. They work on behalf of the insurance company to ensure the claim is handled properly.